TurboTax’s fast factsStarting price: $89 |

TurboTax is the most popular tax filing software in the United States. However, many people have been left wondering if TurboTax is still the best choice to file their taxes after the Federal Trade Commission said that TurboTax engaged in deceptive advertising, promoting “free” tax services to consumers that were ineligible for them.

In this guide, we investigate TurboTax’s pricing plans and break down its pros and cons to help you decide if TurboTax is the right tax filing software for your needs.

TurboTax’s pricing

TurboTax Online offers five pricing plans, three for individuals and two for business taxes.

TurboTax

This plan costs between $0 and $129 to file, depending on whether or not you qualify for a free federal return. State returns cost $64 each if you don’t qualify for the free version. This plan lets you upload tax documents by snapping photos and also includes AI-Powered Intuit Assist. Even the free plan comes with TurboTax’s maximum refund and 100% accuracy guarantees. All of TurboTax’s individual pricing plans also come with support, including this free basic plan.

Live Assisted

This plan costs between $89 and $219 to file federal returns, with $59 or $69 for each state return. It includes on-demand help from tax experts with an average of 12 years’ experience and a final expert review before you file. You’ll also get year-round support from tax experts with this plan, in case you have questions outside of tax season.

Live Full Service

This plan starts at $129 to file federal returns, with $69 for each state return. With this plan, a local tax expert will be matched to your situation and will prepare, sign and file your return on your behalf. This plan includes both W-2 and 1040 forms.

Live Assisted Business

This business tax software plan starts at $489 to file a federal return for your business, with $64 for each state return. It includes on-demand help from tax experts as well as audit defense. This plan is specifically designed for businesses that must file their taxes as an S-corp, Partnership (GP, LP, LLP) or Multi-member LLC.

However, it’s only available in a limited number of states: Alaska, Arizona, California, Colorado, Florida, Georgia, Illinois, Missouri, Minnesota, North Carolina, Nevada, New York, Ohio, Pennsylvania, Rhode Island, South Dakota, Texas, Utah, Virginia, Washington and Wyoming.

Live Full Service Business

This plan starts at $1,169 to file a federal return for your business, with $64 for each state return. With this plan, a business tax expert will be matched to your situation and will prepare, sign and file your return on your behalf. Audit defense is also included in this plan, which is available in all 50 states.

TurboTax’s key features

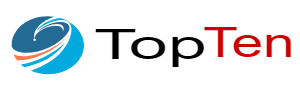

DIY tax filing interface

TurboTax’s software interface is well designed and intuitive to navigate, even if you’ve never used TurboTax or another tax filing software before. The software will walk you through the entire process step by step and even give you an estimate for how much time it will take for you to file your taxes on your own. Only a limited amount of information and prompts are displayed on each screen, so you won’t get overwhelmed as you work through each step.

First, you’ll put in your personal information, such as your full name and Social Security number, then you’ll fill out your federal tax return using information from your W-2 or 1099 forms. After you’re finished with the federal return, you’ll be prompted to create a state return, if applicable. Finally, you’ll review your federal and state returns and then submit them for filing.

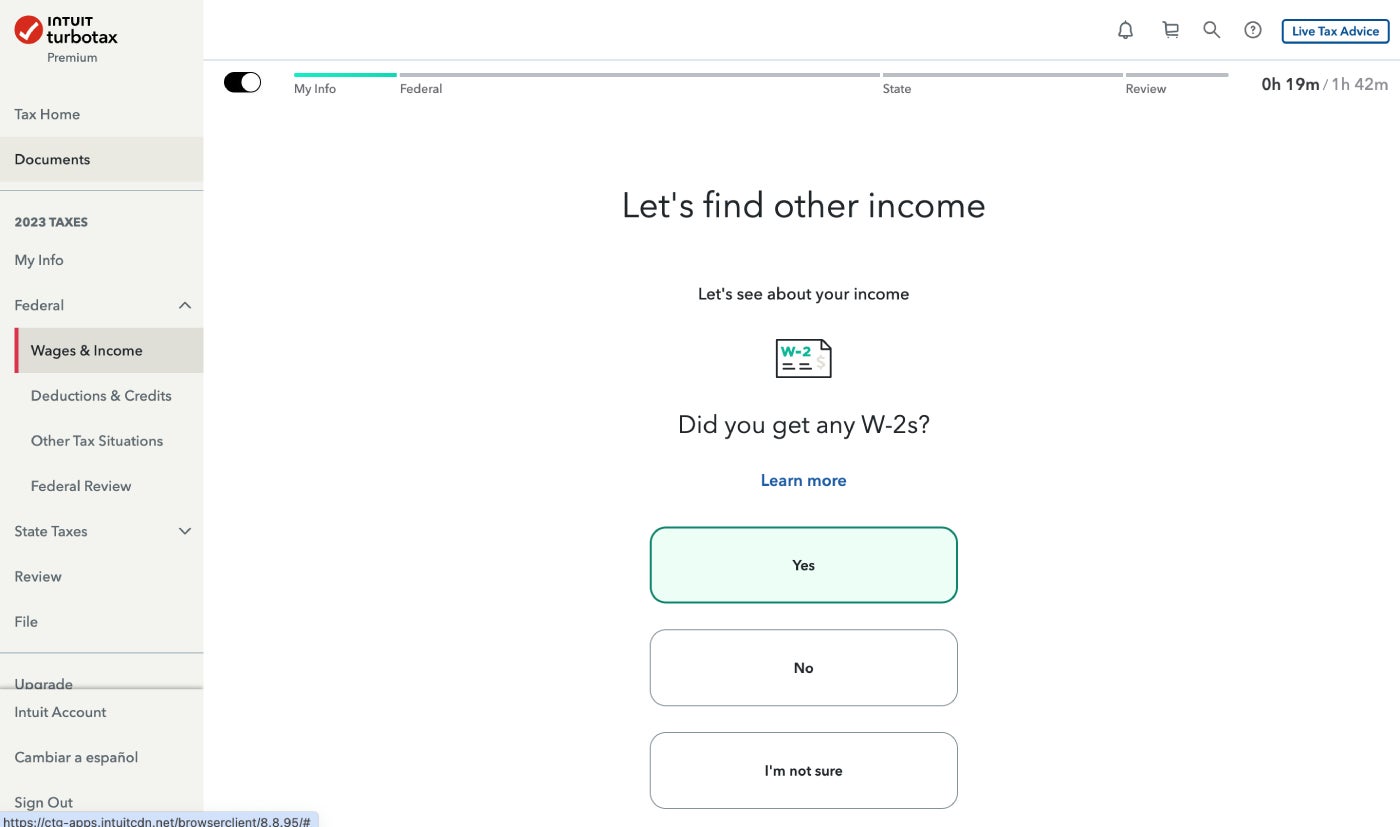

Live Assisted

If you opt to file your personal taxes with Live Assisted, you will go through the DIY tax software and fill out your return on your own, but you’ll also get access to a team of on-demand tax experts, via phone, chat and live on screen. This can be accessed by clicking on the “Live Assist” button in the upper right-hand corner of the interface.

When you access Live Assisted help, you’ll enter some information about your question, then TurboTax will connect you with someone who should understand your specific tax situation. However, if they aren’t able to help you, then you can ask to be transferred to a new expert.

You can share your TurboTax screen with the tax expert, but you cannot share any other tax documents with them, which can be quite limiting, depending on the complexity of your situation. Your personal information, such as your Social Security number, will also be obscured so the tax expert can’t see it when you share your in-progress return with them.

Tax experts are available seven days a week from 5 a.m. to 9 p.m. PT from the January date the IRS starts accepting tax returns through the April filing deadline. From mid-April through early January, they’re available Monday through Friday from 5 a.m. to 5 p.m. PT.

Live Full Service

With TurboTax’s Live Full Service plans, you’ll be matched with a dedicated tax expert, who will do either your business or personal taxes start to finish and review them with you before filing. After you’re matched with your tax expert, they will share the hours they’re available. You can also reach the other full-service experts at the same customer service hours we outlined above in the previous section if you need help when your assigned expert is unavailable. If your same tax expert is available, you can work with them year-round if you wish.

Note that this service is completely virtual, as TurboTax does not have physical office locations like its main competitor H&R Block. However, you may potentially have the option to choose an independent TurboTax Verified Pro, which are independent tax professionals who are vetted by TurboTax and offer the ability to meet in person.

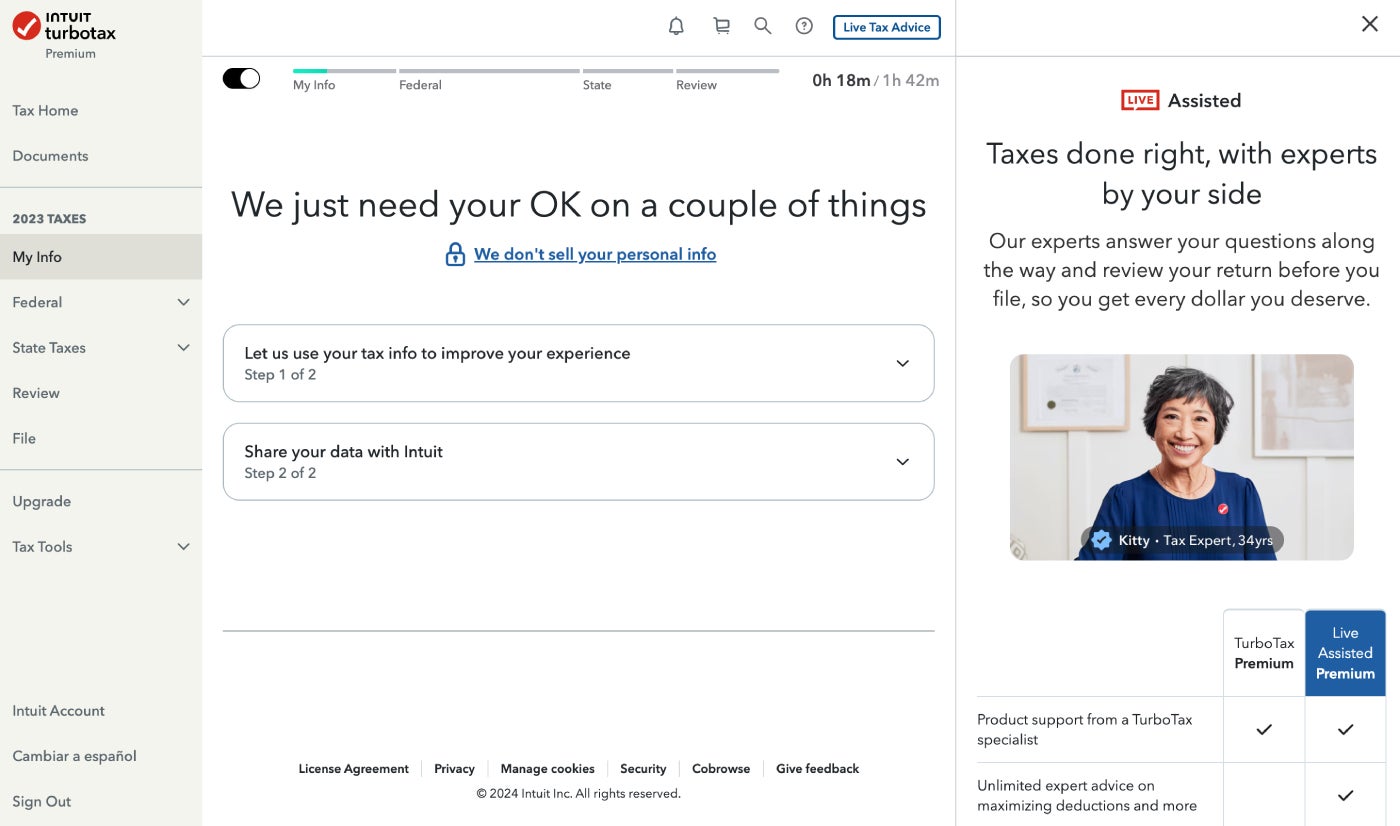

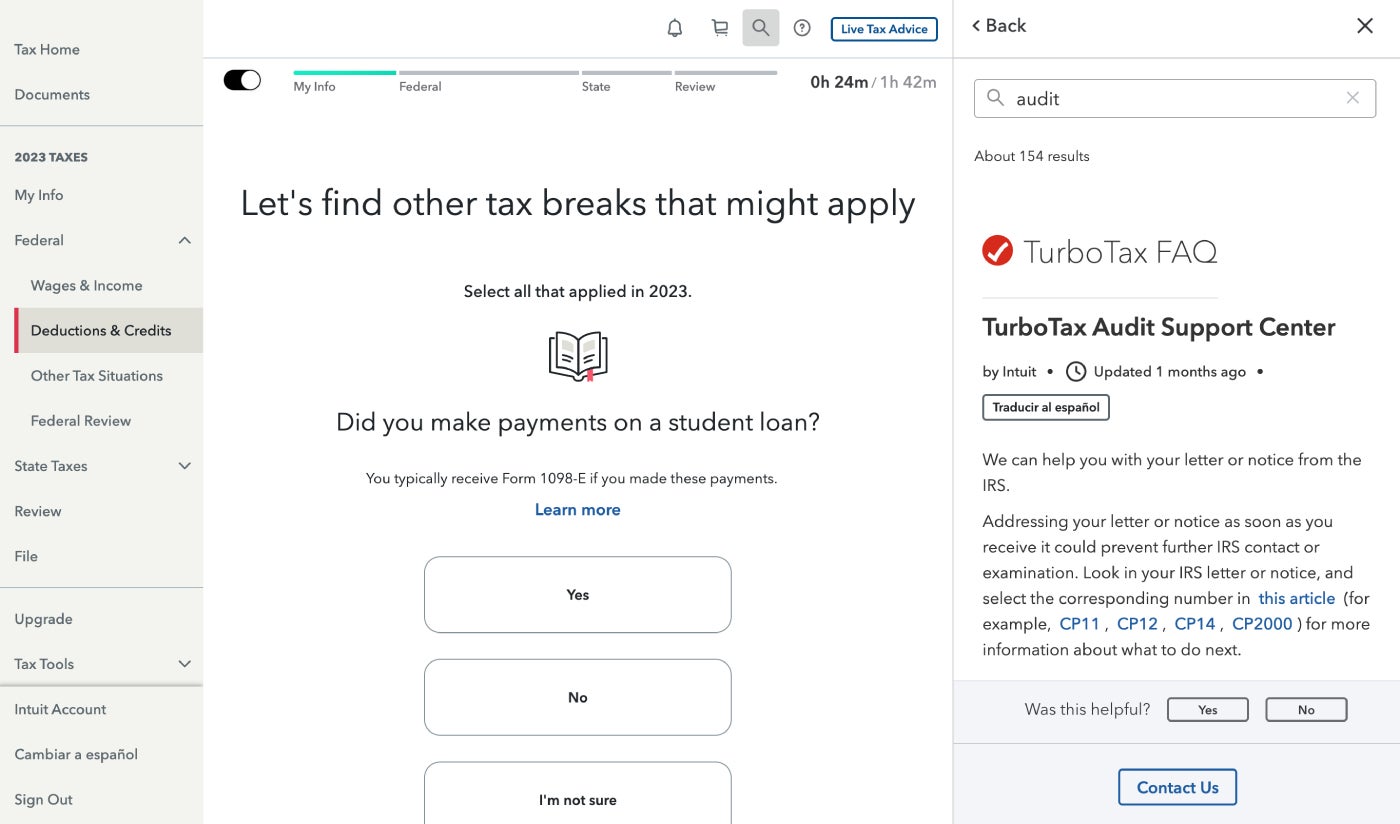

Audit support and defense

All three of TurboTax’s personal tax plans come with an audit support guarantee. With audit support, you get free one-on-one guidance in the event of an audit. They will educate you about what to expect, and how to prepare for an audit, but they won’t actually represent you in front of the IRS. Audit defense is included in both of the business plans, and it can also be added on to the personal plans for an additional fee. With audit defense, you get full audit representation by a licensed tax professional, including representation in front of the IRS.

TurboTax pros

- Intuitive design that’s easy to use.

- Multiple pricing plans and levels of support to choose from.

- On-demand tax advice options.

- Step-by-step questionnaire is simple to fill out.

TurboTax cons

- More expensive than other competitors.

- No in-person option available.

- Live Assisted support may be limited.

Alternatives to TurboTax

| Software | TurboTax | H&R Block | FreeTaxUSA | TaxAct |

|---|---|---|---|---|

| Free federal returns | For simple returns only | For simple returns only | All federal returns | Limited to certain states and income levels |

| Free state returns | Limited | Limited | No | No |

| In-person support option | No | Yes | No | No |

| Starting price (for federal return) | $89 | $55 | $0 | $49.99 |

| Starting price (for state return) | $59 | $49 | $14.99 | $39.99 |

H&R Block

H&R Block is the closest competitor to TurboTax, offering many of the same features. Its pricing plans are more affordable than TurboTax, though. Its free plan also has slightly expanded capabilities, which means more people may be able to file for free using H&R Block instead of TurboTax. H&R Block also has physical offices throughout the United States, so you can meet with a tax expert in person if you prefer that to virtual.

FreeTaxUSA

If TurboTax’s pricing is too steep for you, then FreeTaxUSA is one of the most affordable TurboTax alternatives. Its name is a bit misleading because it isn’t 100% free: FreeTaxUSA charges $0 for a federal return but $14.99 for each state return. It also offers multiple paid add-ons, such as deluxe or pro support and audit defense, but these are all optional.

One of the best things about FreeTaxUSA is that it doesn’t set an income limit for a free federal return, which TurboTax does — meaning everyone gets to file a free federal tax return with FreeTaxUSA, regardless of how much money they made the previous year.

TaxAct

TaxAct is another alternative to TurboTax that offers many online and offline software options to choose from. In addition to different plans for personal tax returns, it also offers bundle pricing for other business structures, such as partnerships and S corporations, which may be appealing to small-business owners. Live tax advice can be added to any pricing plan, including the free plan, for $39.99. TaxAct also guarantees a bigger refund than any other tax software currently on the market.

Review methodology

To review TurboTax, we signed up for the free version of its tax software. We also consulted user reviews and product documentation during the writing of this review. We weighed factors such as pricing, expert advice, live assistance and user interface design when evaluating TurboTax.

FAQ

Is TurboTax actually good?

TurboTax online is very well designed and easy to use, and the interface is intuitive to navigate. The questionnaire-based, step-by-step guide also simplifies the DIY tax filing process.

Is it better to buy TurboTax or use it online?

The desktop version of TurboTax is typically cheaper than TurboTax online. However, not every computer and operating system supports TurboTax desktop. The desktop version is also updated less often than the online version, so it may feel more clunky and less intuitive.

Is TurboTax worth it?

While TurboTax is one of the more expensive tax software available, it’s also extremely intuitive and easy to use and comes with multiple support options. For this reason, many taxpayers still find that TurboTax is worth the price tag — but there are plenty of more affordable TurboTax competitors if you want to explore other options.

What is the problem with TurboTax?

The Federal Trade Commission issued an opinion that TurboTax previously engaged in deceptive advertising, promoting “free” tax services to consumers that were ineligible for it. TurboTax made it seem as if all or most consumers were eligible to file free federal and state returns, when in actuality only a small minority of people qualify for the free version.

Which is better, TurboTax or H&R Block?

H&R Block is TurboTax’s closest competitor, but it offers several advantages over TurboTax, including cheaper pricing plans and the option to get in-person assistance at an H&R Block office.